The IRS does not play games.

When you file your taxes the IRS expects you to include every penny of your TNC earnings, tips, your full-time job, and that $20 that you made from mowing your neighbor’s lawn.

If you miss ANYTHING, expect them to show up with a calculator in tow asking for their money.

The thing is, you shouldn’t play games either. As a rideshare driver, you have the opportunity to save $1,000’s per year if you accurately record your business miles and report them on your tax returns.

And every single dollar counts.

Let’s take a look at how much you should be deducting from your taxable income per mile.

For 2018 (filing your taxes in 2019) the rates are:

- 54.5 cents per mile for business reasons.

- 18 cents per mile for medical purposes.

- 14 cents per mile for charity reasons.

For 2017 (filing your taxes in 2018) the rates were:

- 53.5 cents per mile for business reasons.

- 17 cents per mile for medical purposes.

- 14 cents per mile for charity reasons.

*The standard mileage rates can change each tax year — be sure to verify that you’re using the correct rate.

That first figure is what rideshare drivers should pay attention to. Sure, it may not seem like a lot but let’s take a look at how much not tracking your miles could be costing you.

Cost of not tracking miles

To calculate the cost of not tracking your miles, we’ll be using a modified version of this spreadsheet. Please note that Gridwise did not create this spreadsheet. All props go to the creator!

Now, let’s start by looking at how much a part-time driver could be saving by tracking their miles in a given week. We’ll assume the following:

Here, we’re assuming that as a rideshare driver we make 13.91 per hour, which is on par with what Chicago area drivers make on average according to Glassdoor.

We’re also assuming that over 25 hours, we are giving about two trips per hour and driving roughly 10 miles per trip. This is including miles we drive between passenger pickups and while driving to pick up a passenger.

Given these figures, we can calculate the following:

As you can see you have a total mileage deduction this week of $267.50 given a 53.5 cents per mile deduction.

We can also see that given these calculations, we will be paying roughly $45.64 in taxes.

Now let’s see how much we would be paying if we had zero deduction.

Here we can see our tax liability increases to $210.73! Why? When you spread out that $267.50 deduction across all of your potential tax brackets, you will see that it has a $165.09 net effect on your taxes.

That means as a part-time driver if you’re not tracking your miles you could be losing $165.09 per WEEK.

If you’re a full-time driver, the effects are even more drastic. Let’s say we bump up our driving numbers to the following:

We’re again assuming that we make $13.91 and average just under two trips an hour. We have ticked down miles per trip to 9.

Now let’s see how our tax liability changes:

Here you can see my total deduction bumps up to $481.50 and I’m paying $166.44 in total tax.

If I did not track and deduct my miles, however, I will be paying much more.

Without our deduction, we are up to $463.60 in total taxes paid! That means we’ll be losing $297.16 by not tracking miles.

What about Uber’s Year-End reports?

TNC’s do give out year-end driving reports at the beginning of each year along with your 1099 which gives you the number of miles that you’ve driven with passengers, however, that does not include more than 25% of your miles.

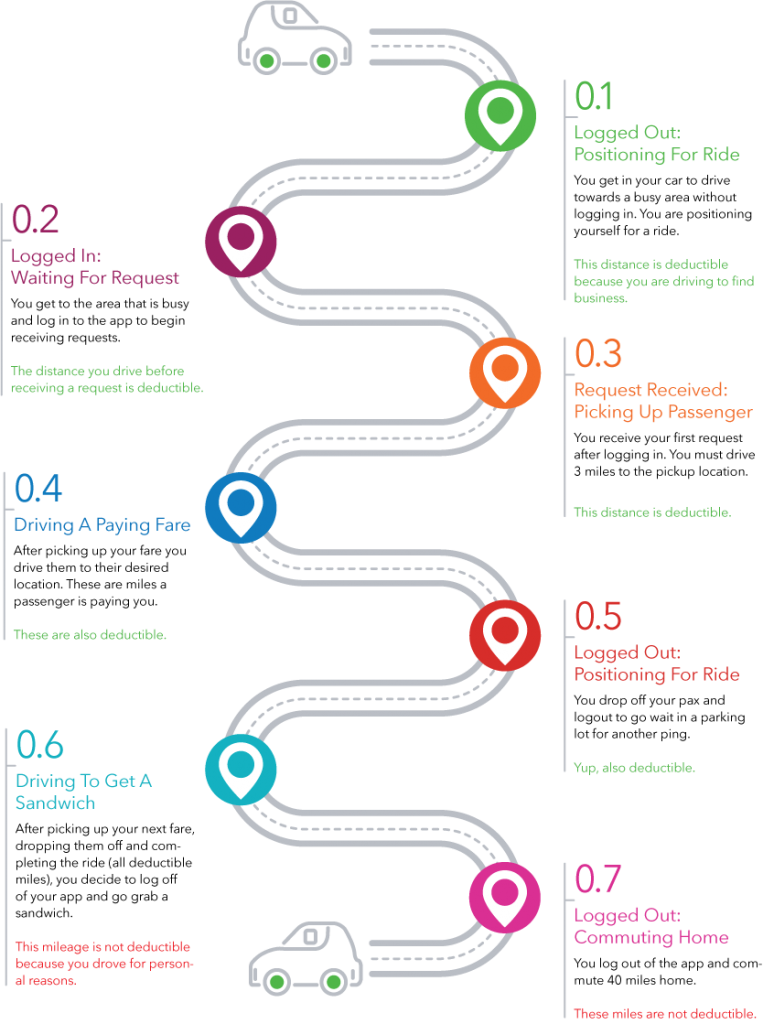

As a rideshare driver, there are 5 points in which you can track and deduct miles according to The Rideshare Guy.

- When you are logged out and positioning yourself for a ride

- When you are logged in and waiting for a ride request

- When you are driving to pickup a passenger

- When you are driving a passenger

- After you drop off a passenger and logout again to position for a ride.

Check out the image below for further details:

Most TNC’s will only give you reports for when you are driving and paying a fare, so you could be missing out on a significant amount of mileage if you solely rely on the reports that Uber, Lyft, or another TNC gives you.

Rideshare drivers could be missing out on 25% of their potential mileage deduction or more by just relying on the reports that TNC’s send out. That means of the $297.16 in potential tax savings rideshare drivers could be receiving, they could be missing out on $74.29 per week or more.

Ensure you track ALL of your miles

Make sure that you are tracking ALL of your miles with Gridwise’s shift tracking feature. When you start driving, you’ll automatically be alerted to start tracking your miles.

At the end of every shift, you’ll be prompted to enter your earnings, and you’ll be able to see how many total miles you drove (not just miles with a passenger).

You can then see a complete history of your driving miles and earnings. We’ll also keep track of your current deduction.

So what are you waiting for? Start tracking your miles NOW so you can maximize your tax deduction and your earnings using the free Gridwise app!