Expense tracker app for gig drivers

Gridwise is an expense and mileage tracking app for rideshare and delivery drivers. In addition to business expense tracking, Gridwise helps you effortlessly track mileage and earnings to help you save more money during tax season.

Tracking mileage and earnings with Gridwise is simple. To track your mileage and hours, just turn the mileage tracker on when you start your shift and turn it off when you get home. To track your earnings, just link your rideshare and delivery accounts and your earnings will be synced automatically.

With Gridwise you can easily see how much you made per hour and how much you made on each app, so you can decide how to best spend your time.

Tracking vehicle expenses

Understand your bottom line by tracking all of your rideshare and delivery driving expenses in one place.

Automatically track your earnings

Automatically sync earnings from every service you work for and easily see how much you are making on each.

Track your mileage

Effortlessly track all of your gig driving miles and maximize your tax deduction.

Mileage and expense tracker app

Gridwise was built specifically to track rideshare and delivery driver expenses and miles, simplifying your taxes to get you the maximum deductions you deserve! Gridwise offers free mileage tracking, driving stats, analytics, and airport and event schedules. If you’re a rideshare driver who needs to track mileage, earnings, and expenses across multiple rideshare apps, Gridwise is a great option. We support over 300,000 drivers across over 20 different gig service platforms. We offer insights that help you earn more money when you drive, and save more money when tax season arrives.Track earnings and expenses

Gridwise syncs with your delivery driver and rideshare apps so you can track mileage, earnings, and expenses effortlessly across all services. Gridwise supports Uber, Lyft, DoorDash, Uber Eats, Grubhub, Gopuff, and more.Track mileage

As a rideshare or delivery driver, tracking expenses and mileage is crucial for maximizing your earnings and reducing your tax burden. The easiest way to keep track of your rideshare miles is with the Gridwise mileage tracker. Start tracking your miles when you go online with your driver apps and stop tracking when you get home at the end of the day.Download Gridwise for free today →

Love the expense tracking feature

Excellent product that does exactly what I needed for tracking expenses and mileage as a delivery driver. Even links with Uber, DoorDash, and others. Amazing and free. I may honestly consider the paid version just because the free one is so highly functional, something you don’t often come across these days.

— Jared

Expense tracker app for gig drivers

I recommend this app to anybody who has a rideshare job. It tracks your miles and expenses, and offers extra benefits like life insurance and gas discounts. I find it to be the best there is right now.

— Valentine V.

Business expense tracking for gig drivers

I DoorDash, so Gridwise has worked out great for me. It incorporates my mileage, my income, and how much I can write off in taxes for my mileage. You can also manually put in any other expenses and it will calculate those as well. It also gives you advice on when and where to work to make the most money. Anyone who does gig work driving should definitely check out Gridwise.

— Teri R.

Frequently Asked Questions

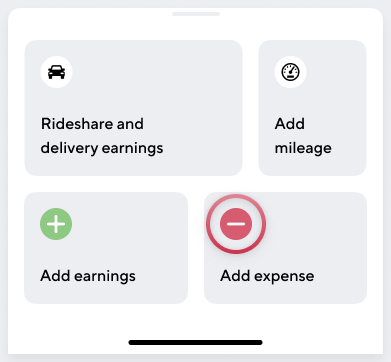

How do I track my expenses?

From the Earnings tab, tap the black plus (+) button in the top right corner of the screen.

Tap on Add expense.

Enter the cost of the expense. If you’d like, you can also give it a category and date.

Tap on Save in the upper right corner of the screen to save your expense.

How do I track my mileage?

From the Earnings tab, flip the steering wheel switch at the top of the screen to start the mileage tracker. Flip it again when you stop driving to save your mileage.

![]()

Gridwise will also send you a notification when it notices that you are driving to ask if you want to start the mileage tracker. Just open the notification to start the tracker.

How do I see my deductions?

From the Earnings tab, you can easily see your total expenses for the year, as well as an estimate of your mileage deduction based on the miles you’ve tracked in the app.

You can also easily create tax reports for your earnings, expenses, and mileage. These can be useful when it’s time to file your taxes.